Introducing the Opportunity: Can Individuals Released From Personal Bankruptcy Acquire Credit Rating Cards?

Understanding the Effect of Bankruptcy

Personal bankruptcy can have a profound impact on one's credit history rating, making it testing to access credit history or financings in the future. This financial stain can linger on credit history records for a number of years, impacting the individual's capacity to secure favorable interest prices or monetary chances.

In addition, insolvency can restrict employment possibility, as some companies carry out credit history checks as component of the working with procedure. This can pose an obstacle to people looking for new task potential customers or job innovations. Generally, the impact of personal bankruptcy prolongs past economic constraints, influencing numerous facets of a person's life.

Aspects Influencing Bank Card Approval

Complying with bankruptcy, individuals often have a reduced credit rating due to the negative impact of the insolvency filing. Credit history card companies usually look for a debt score that demonstrates the candidate's capability to take care of credit history properly. By carefully considering these factors and taking actions to rebuild credit post-bankruptcy, people can enhance their potential customers of obtaining a credit score card and working towards financial recuperation.

Steps to Restore Credit Scores After Insolvency

Reconstructing credit report after bankruptcy needs a tactical technique concentrated on financial technique and regular debt administration. The very first step is to evaluate your debt report to ensure all financial debts consisted of in the insolvency are properly mirrored. It is essential to develop a spending plan that focuses on financial debt repayment and living within your methods. One reliable method is to acquire a protected credit scores card, where you transfer a particular quantity as collateral to establish a credit line. Timely payments on this card can demonstrate accountable credit rating usage to possible lending institutions. Furthermore, consider becoming a licensed user on a family members member's bank card or checking out credit-builder finances to further enhance your debt score. It is important to make all payments on schedule, as repayment background dramatically impacts your credit history. Perseverance and willpower are vital as rebuilding credit report takes time, but with commitment to sound economic practices, it is possible find more to enhance your creditworthiness post-bankruptcy.

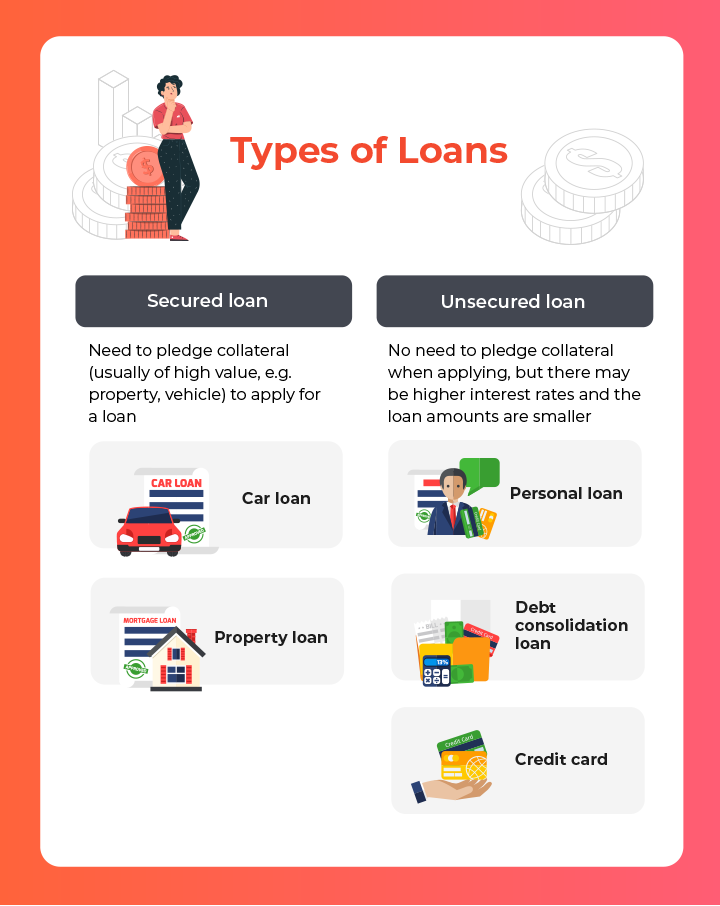

Guaranteed Vs. Unsecured Credit Cards

Complying with bankruptcy, people commonly consider the selection between safeguarded and unsecured credit report cards as they intend to reconstruct their creditworthiness and financial security. Guaranteed credit cards call for a money deposit that offers as security, normally equivalent to the credit report limitation given. Eventually, the selection in between secured and unsecured credit scores cards must straighten with the individual's economic goals and ability to take care of credit report sensibly.

Resources for People Looking For Credit Score Reconstructing

One beneficial source for people looking for debt restoring is debt therapy firms. By working with a credit scores counselor, individuals can gain understandings into their debt records, find out strategies to boost their credit ratings, and receive guidance on handling their finances successfully.

One more helpful source is credit score tracking solutions. These solutions allow individuals to keep a close eye on their credit report records, track any type of modifications or mistakes, and find possible indicators of identification burglary. By checking their credit report on a regular basis, people can proactively deal with any kind of concerns that might develop and make certain that their credit rating details depends on date and accurate.

In addition, online devices and sources such as credit rating simulators, budgeting applications, and monetary literacy web sites can provide people with valuable details and devices to assist them in their credit rating rebuilding view publisher site journey. secured credit card singapore. By leveraging these sources effectively, people released from personal bankruptcy can take purposeful steps towards enhancing their credit scores wellness and protecting a much better financial future

Conclusion

In verdict, people discharged from insolvency may have the opportunity to get charge card by taking actions to restore their credit score. Factors such as credit history, earnings, and debt-to-income ratio play a substantial function in charge card authorization. By recognizing the influence of bankruptcy, choosing in between secured and unsafe credit report cards, and utilizing sources for credit scores restoring, individuals can improve their credit reliability and potentially obtain access to credit report cards.

By functioning with a credit score therapist, people can obtain insights into their credit report records, find out approaches to increase their credit report scores, and get support on handling their financial resources effectively. - secured credit card singapore

Comments on “The Leading Features to Search For in a Secured Credit Card Singapore”